Contents:

Waiting for a price reaction enables a trader to use a tighter stop loss for this setup as the recent candle high or low plus a buffer could be employed. Fibonacci clusters are areas of potential support and resistance based on multiple Fibonacci retracements or extensions converging on one price. Tirone levels are a series of three sequentially higher horizontal lines used to identify possible areas of support and resistance for the price of an asset. While the retracement levels indicate where the price might find support or resistance, there are no assurances that the price will actually stop there. This is why other confirmation signals are often used, such as the price starting to bounce off the level. When these indicators are applied to a chart, the user chooses two points.

Cory is an expert on stock, forex and futures price action trading strategies. The reasoning behind this method of setting stops is that you believed that the 38.2% level would hold as a resistance point and the currency pair price would move in your direction. Therefore, if the price were to rise beyond this point, your trade idea would be invalidated. You can see in the chart above that I labeled each step of the Fibonacci channel trading strategy. At one time, the AUDUSD downtrend offered an interesting chart to search for short setups. In fact, the price had already approached the 38.2 retracement level, which could have easily become a turning spot for downtrend continuation.

Drawing Fibonacci retracement levels is completely streamlined in our GoodCrypto app. The only thing you need to learn through trial and error is where to place Fibonacci retracement, as there is no particular rule on how to draw Fibonacci retracement correctly. Selecting a relevant high and low price should be your starting point, depending on the timeframe that you are trading on.

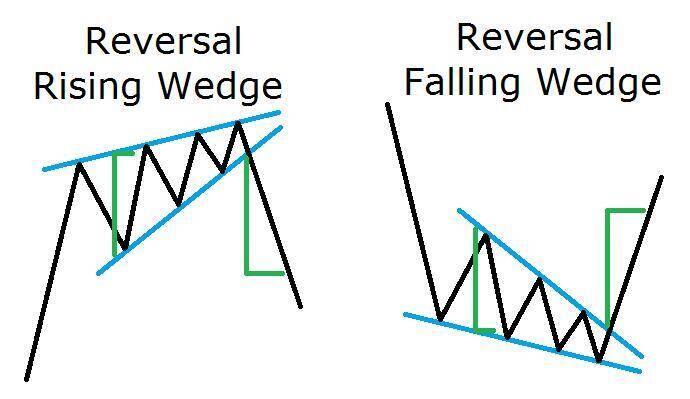

When you draw a Fibonacci retracement on your chart, you will notice that we do not actually use the numbers in the sequence. Instead, the ratios or differences between the numbers in the sequence are utilised. The next step requires that you wait for a counter-trend reversal and the chart image above shows an example where the previous upward trend ended and a new downward trend started. An additional indication that a trend might have ended is when price also breaks below a previous level of market structure .

There are multiple ways to trade using the Fibonacci Retracement Tool, but I have found that one of the best ways to trade the Fibonacci is by using it with trend lines. We also have training on Trend Line Drawing with Fractals. The advantage of the H4, in this case, is the potential for an earlier entry and hence more space to targets as well.

Milan Cutkovic has over eight years of experience in trading and market analysis across forex, indices, commodities, and stocks. He was one of the first traders accepted into the Axi Select program which identifies highly talented traders and assists them with professional development. The final example image above does not display any trade entries but clearly shows how price tends to stop at Fibonacci extension levels during a strong trending market. Note how both examples offered much bigger returns versus the initial risk taken. Not all trades work out all the time, so it’s essential to have a strategy that covers your losses whilst maximising your profits over the long run.

If it’s an uptrend, you want to start with the swing low and drag your Fibonacci level all the way up to the swing high. If it’s a downtrend, you start with the swing high and drag your cursor all the way down to the swing low. You can also read the strategy on how to use currency strength for trading success. This another great way of combining various technical analysis tools in the Forex market. In any case, Forex traders want to place the Fib in the correct place, which is from the bottom to top in an uptrend and from top to bottom in a downtrend. This move from top to bottom can also be called “swing high swing low”.

This would limit your downside risk while giving you a chance to earn a higher profit on the trade. If the price fails to keep the upward trend, your stop-loss would be triggered without hurting you too much on one trade. In contrast, you could earn a much bigger price if the price indeed carried on with its existing trend. Fibonacci retracement indicator is quite useful in determining entry and exit points in a trending market. Traders can also use it for risk management purposes as it allows them to find stop-loss and take-profit points.

BT share price is rallying: Does it have more room to run?.

Posted: Tue, 04 Apr 2023 08:31:00 GMT [source]

However, if the stock breaks through these levels, traders may consider exiting their positions, as this could signal that the stock is losing momentum. After analyzing the charts, you determine that the stock has recently made a significant move from $100 to $150. You can use Fibonacci extensions to determine where the stock may find support or resistance on its next move. Fibonacci retracement levels are calculated using Fibonacci sequence ratios. The most commonly used ratios are 23.6%, 38.2%, 50%, 61.8% and 100%.

Even though the Fibonacci retracement levels are a popular tool to identify potential support and resistance levels, there’s no guarantee that the price will bounce from these levels. Investors and traders use Fibonacci fan as a way to make informed decisions about buying or selling an asset. The tool is particularly useful for those who follow a momentum or trend-following trading strategy, as it can help identify key levels where the trend may reverse or continue. The combination of trend analysis and Fibonacci retracement levels makes the Fibonacci fan a powerful tool for technical analysis. Another popular Fibonacci strategy is to use the 61.8% retracement level as a take profit level. This is based on the idea that the 61.8% level represents a strong resistance level and that prices are likely to try to break this level.

However, GoodCrypto is much more than just a free tool for drawing Fibonacci trading ratios. After reading this article, the automatic Fibonacci retracement indicator will have no secrets for you. You will be able to construct your own Fibonacci retracement day trading strategies and place market entries and exits. But before we delve deeper into practices of trading Fibonacci, let’s begin with a short introduction on what is Fibonacci retracement and how it was discovered.

Avoiding The Bear Trap: Crypto Beginner’s Guide.

Posted: Fri, 14 Apr 2023 14:02:44 GMT [source]

Demo account and see how well these levels predict support and resistance lines. These are commonly used levels that the price could retrace back to, although there are other retracement levels that have been identified and work well. Overall, Fibonacci projection is a valuable tool for traders and investors looking to gain insight into potential market movements and make informed investment decisions.

And we do not want any of that to happen to you, so let’s check out the criteria to enter to help us make a safe entry. This rule is the critical step to the strategy so you need to pay close attention. Now you can get your Fibonacci Retracement tool out and place it at the swing low to the swing high. He developed a simple series of numbers that created Fibonacci ratios describing the natural proportions of things in the universe. I, therefore, kept a close eye on the upcoming 4-hour candles looking to see if the price showed renewed bearish signals or will it keep retracing higher.

The most common use for Fibonacci levels is the regular retracement strategy. After identifying the ‘A to B’ move, you pay attention to the retracement level C. Now that you know the formula for Fibonacci retracement levels, you can learn how to actually calculate them. JumpstartTrading.com does not track the typical results of past or current customers.

DraftKings stock price: DKNG is ripe for a 80% jump if this happens.

Posted: Wed, 19 Apr 2023 08:55:00 GMT [source]

Although you will get fill at better price – possibly it will happen when this level will be broken by the price action, and instead to get out – you will just get in. It’s a harmonic pattern that traders use to determine take profits and potential reversal points. Both the 382 and 618 are popular fib levels, but more on that shortly. You can search and read all about these ratios existing in nature, but for our purposes this is enough. Worth noting is that we were able to provide every Fibonacci sequence crypto trading strategy in this article just by using our GoodCrypto trading app.

Use them to open trades at the best price at the end of the correction. Even at the moment of exiting the flat, it is sometimes difficult to determine the starting point. The next position would have to be opened only on the next rising candle , however, it is not the beginning of a confident growing trend. Situations like this happen sometimes — they are difficult to foresee and therefore provided for in this high risk management.

Traders use these ratios – 23.6%, 38.2%, 50%, 61.8%, and 100% – to identify support and resistance areas for markets. Fibonacci retracement levels are horizontal support and resistance levels located at a fixed distance, which is calculated using a coefficient. They are simply percentages of the magnitude of the price movement and are plotted on the trend during the correction. They are used to identify potential resistance levels exceeding the swing high or to identify support levels below the swing low.

There are advantages and disadvantages to using a trailing stop. Our team tested a few different https://traderoom.info/s with this strategy and agreed that a trailing stop loss is the way to go with the Fibonacci Channel Trading Strategy. Your stop loss can vary based on what your charts are showing you.

The article demonstrated how to use Fibonaccis efficiently in your trading. However, don’t make the mistake of idealizing FIbonaccis and believing that they are superior over other tools and methods. Nevertheless, Fibonacci is a great tool to have and can be used very effectively as another confirmation method. Whether you are a trend following or a support and resistance trader, or just looking for ideas how to place your take profit orders, Fibonaccis are a great addition to your arsenal. Take profit order is slightly different because some traders prefer to close part of the trade at the closest resistance line and move the Stop Loss to breakeven.

Once in fullscreen, you can proceed to draw your fibonacci stop loss retracement by using the integrated Fibonacci retracement lines tool. To access this Fibonacci retracement charting tool, activate the drawing tools by clicking on the icon with a square and a cross in the middle. Using Fibonacci retracement is appealing because there are no set rules on how to properly use Fibonacci retracement. You just need to select two points, one high and one low. Any point that seems relevant to you in a price trend can be used as a reference.

We don’t recommend doing this without some other confirmation. One way to trade the Fibonacci retracement is to compare it with an intraday vwap boulevard level or wait for a lower high to form. The Fibonacci levels are based simply on percentages and are derived by dividing a number by the next one in the sequence.

Recent Comments